If you want to see the biggest change that took place due to cryptocurrency than it will definitely be the ICO (Initial Coin Offering). It came into trend when altcoins made their appearance which consequently, made generating crypto tokens very easy. It was instantly picked up by those were seeking an opportunity to work on a new technology or business idea and needed funding for that.

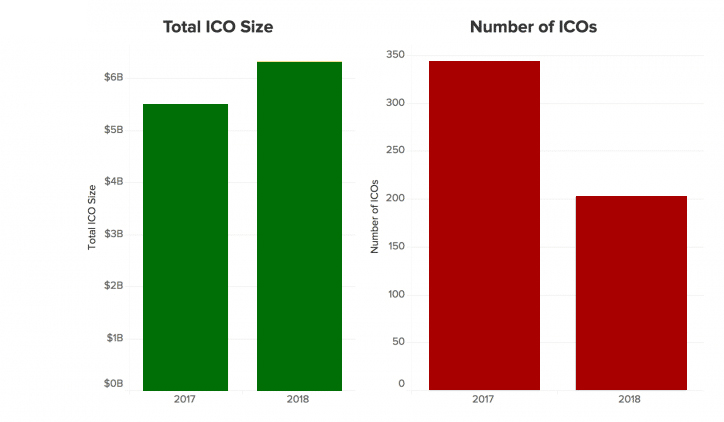

In the year 2017, this instrument of crowdfunding saw a meteoric rise with a whopping sum of $5.6 billion raised collectively by all the projects. It continued to grow even in 2018 and stood with of $6.3 billion.

See the chart to check the difference in the growth of ICO in two consecutive years:

These stats show how impactful this instrument has been on the market. It continues to grow and reach higher number of investors across the globe. This article will give an overview about ICO, its trends and speculations on future.

What is Initial Coin Offering?

ICO is nothing but a crowdfunding event under which tokens are sold and raised funds are used to start blockchain-based tech venture. The project could belong to any industry and they have made many feats achievable:

The funding for the development of DAPP has been possible only with ICO.

Anyone can launch his/her project and anyone can participate in it. There is no restriction of boundaries as well, you can in any offshore and onshore project.

It become publicly known in the year 2014 when the Ethereum ICO raised $18.4 million and began a new revolution based on technology.

In the beginning, ICOs were launched only for the development projects of new cryptos. Tokens that have been created and all sought by the investors can be easily sold.

After Ethereum succeeded as a cryptocurrency, it quickly took over the market and became the most prominent method for developing new coins. Its unique ecosystem makes mass manufacturing of coins possible without spending large quantum of GAS.

A Brief History of ICO

According to the records, the first cryptocurrency introduced by ICO was Ripple. The project was spearheaded by the Ripple Labs in 2013. They created around 100 billion and sold them to raise funds for supporting the development of Ripple platform.

In the same year, Mastercoin introduced its own project for creating a layer over Bitcoin for tokenizing the transactions and integrating smart contracts. The project ended up raising $1 million through the sale of Mastercoin tokens against Bitcoin.

There are many other cryptocurrencies which were funded with ICO. In 2016, Lisk was introduced and it managed to raise around $5 million. However, the most successful cryptocurrency introduced through ICO has been Ethereum. It was sold at the price of 0.0005 Bitcoin each and raised nearly $20 million. So far, Ethereum has been the biggest success in the history ICO-based projects.

After making smart contract an integral part of its mechanism, Ethereum became a pioneer in the ICO sphere.

Ethereum – The Crowdfunding Machine

The landmark feature of Ethereum is that any token created on its smart contract system can be transacted on the blockchain as well. The introduction of ERC20 standardized these types of contract. It also marked Ethereum as as a host of wide varieties of ICOs, it soon became a part of every crowdfunding campaign.

The DAO platform has been the most influential demonstration of Ethereum and its smart contract’s potential. When the distributed investment company was launched, it received Ether worth $100m. In return, the investors received enhanced market price for their own shares and also participated in management of DAO. However, the idea failed after the platform was hacked.

As mentioned before, Ethereum became a default choice every project projects and it is still reigning this sphere. Apart from that, it is very easy to develop the tokens using its ecosystem. You just need to past the contract in your wallet after transferring ETH and that’s it. The token appears in your wallet and enables you to transfer it wherever you want.

Before heading further, we need to understand the basics of the token.

Token = Cryptocurrency

These days, the word ‘token’ is used a lot, there are only a few who know what this term truly means. It is actually very hard to settle on one definition as token can be explained in various other ways. But we can try to understand it with broad definition:

A tokens holds a certain value in its distinct ecosystem. It comes with different functions such as voting rights, valuing and staking as well. The functionality of token cannot be limited to some certain extent, it can have diversified role in its own ecosystem.

However, cryptocurrency coins and tokens are two different things. Bitcoin, Bitcoin Cash and Ethereum are cryptocurrency coins because they possess a certain even outside their ecosystem.

On the other hand, projects such Golem and OmiseGo are token because have a value only inside their own smart contract platform like Ethereum.

As per the directive of Securities and Exchange Commission of US, tokens are classified into two types:

Security Tokens

Utility Tokens

Howey Test is the method to determine if a particular crypto token could be considered a security token or not. There are conditions which have to be met by the token to pass this test:

Can it be considered an investment of money?

Is investment taking place in a common enterprise?

Can profit be expected from the work of promoters or the third party?

Note: The term “Common Enterprise” has been under discussion for a while now. However, most of the federal courts consider it a regular venture in which investors can pool.

The very essential nature of ICO makes it an investment opportunity and therefore, the tokens launched under it are classified as security. Moreover, they are subjected to federal regulations and securities as they obtain their value from extraneous tradable assets.

Utility Token

Tokens that pass Howey Test are classified as security tokens and those who fail are considered Utility token. These tokens are just concerned with certain products or services and gives users a few privileges:

Enabling holders to use a specific network.

Empowering holders with right to vote for taking advantage of the network.

Hopefully, we have been able to make ICO and token clear to you. Lets peek into the mechanism and see how they work:

There are smart contract platforms such as Ethereum and Neo that let developers create Dapps using their architecture. You can compare them with with supercomputers that are empowered with Dapps which executable inside the mechanism.

For the purpose of raising funds for the project, only a limited amount of tokens are released. There are few reasons which make limiting the number of token necessary:

- It determines the goal of ICO.

- As soon as the demand goes and the supply is not renewed, the price of tokens increase automatically. The predetermined price of tokens fluctuate on the basis of their demand.

ICO trading has been simplified and made more commonplace lately. It is done following a very simple process of buying which includes sending cryptocurrency to crowdsale address. For example, if the platform is Ethereum, then the payment has to be made in Ether. Once that is done, you get all the tokens you are supposed to receive. Needless to mention that it is an overview, the marketing goes to multiple stages. At one point of time, ICO marketing campaigns became so prevalent that the social media biggies such as Twitter and Facebook had to ban all the ICO-related ads.

Pros and Cons

Pros

Without a doubt, ICOs became a promising platform for all the entrepreneurs. It allowed them to raise funds for their business without getting into tedious banks and NBFCs. The best example of that could be Ethereum. It has been the most successful project over last 3 years. It has also given a platform for the other projects to develop.

The centralized mechanism always deterred the effort of business aspirants and made IPOs (Initial Public Offerings) a cumbersome task. On the other hand blockchain-based projects have brought ease into the entire process of establishing a business.

What is ICO Whitepaper?

It is a comprehensively written document which explains the very gist of the business. It explains the existing problems and the gives the the solution as well. It elaborates the method which is used in the project to resolve all the issues. Above all, it should be able to convince the investors to trust the project and put money in it.

This document is accountable for establishing a relationship between the project and people who would be effected by it. It targets the entire community that will be benefitted by the solution provided by this project. It won’t be wrong to say that the ICO whitepaper is the crux of your project and it requires a great deal of attention.

The biggest example of this is Quantstamp. This project was able to raise more than the stipulated amount because it struck a chord with the community through its whitepaper.

The impact of ICO is clearly manifested blockchain-based crowdfunding events where a project is able to collect $6.8 billion in just 4.5 months. You can imagine how much the hype and demand have contributed for the success of these projects.

In the same way, ICO projects also boosts the confidence of developers to go extra mile and create something extraordinary. They get handsomely paid for such projects.

Same thing applies for the investors too, they get an opportunity to invest in a type of project which has never happened before and gives a great chance of voluminous profits. For instance, Ethereum was trading for 40-50 percents in the beginning and currently, its value is $477 each.

Cons

To start with, ICOs are known to make fund-raising easier with lesser paperwork. At the same time, they bring a loophole into the entire mechanism, making it vulnerable to scammers. The paucity of paperwork also makes it easy medium to be used by any miscreant as well.

All they do is create a fake whitepaper, website and a token purchase mechanism through which they can receive payments. They make their appearance very genuine for the investors.

It becomes very hard to discern between a genuine project and fake one. Because they both try to convince investors with their website and whitepaper. Moreover, you don’t physically meet anyone, you just read whitepaper and see the website before making the investment. And you have no idea if the people you are giving money to are entrepreneurs or scammers.

Therefore, before making any such investment you need to consider a few things. First, 90% of the startups fail because of the ineffectiveness of their idea and various other reasons. Furthermore, blockchain-based based projects are highly prone to falling prey to hackers if there is a single mistake in coding.

There have been several instances when the crypto whales have created big issues at the time of ICO sale. BAT ICO is the most infamous example of such an incident so far. The ICO collected a whopping amount of $35 million in just 24 seconds. It was discovered that tokens released were owned by various individuals, which violated the very basics of decentralization.

Such individuals are called “crypto whales” or “whales” in cryptosphere. They have significant financial clout which helps them bypass the transaction fee during crowdsale. On the occasion of BAT ICO, the total amount paid by the whales was approximately $2220.

ICO becomes a very painstaking process when it happens in accordance with blockchain. And it is true that the blockchain is not ready for such a heavy duty activity which happens on a global scale.

The landmark collection of $100 million took a toll on the Ethereum blockchain. It resulted in a clog that prevented a lot of others to participate as the transactions were not successful.

It also works the other way around.

It happened with SophiaTX ICO when they had to delay its crowdsale because the channels have been clogged up and resulted in the failure of Ethereum blockchain.

The increasing number of Ethereum wallets has made the storage of all ERC tokens very easy. It gets more challenging when the coins have to be transferred to other platforms. It happens very frequently that the tokens are not compatible with the other wallets and their storage become a tiresome activity.

You must be aware that regulatory bodies such as SEC and CFTC have started taking interest in ICOs. They have been declared necessary for the US-based ICOs to have security tokens in the campaign. Their presence now attracts eyeballs across the globe for any sort of project.

Lastly, the government does play a decisive role with its intervention. That happens, because ICOs allow a big quantum of unregulated money to come into the market. Most of the governments consider them unsafe and puts legal restrictions on them. The recent example of this is India and China.

Legal Stand of ICOs

When it comes to legality, disposition of ICOs is very unclear. A token cannot be sold as a financial asset, it is rather presented as a digital good like many other commodities. That is also a reason that the even of ICO is called ‘crowd sale’. In most of the jurisdictions, the funding of ICO is unregulated. As a result, it becomes easily executable and paperless, alongwith legal consultation.

As stated earlier, ICOs are under inspection by many regulatory bodies such as SEC and CFTC. That is because, they are now being released as security tokens rather than utility tokens. It all started when SEC declared Dao ICO a security and it introduced an all new model for regulation.

Expert from Coindesk, Ash Bennington explains why Dao was considered a security, in a fable:

A group of developers started a DAO

The developers said:

There are plenty of blockchain-based projects and apparently, there’s no way to arrange for their funding.

We would simply roll out a project with tokens that have written codes. We would sell those and use their profits to support the project.

We would work on the code and they would buy our projects. As the projects succeed, everyone will be benefitted.

The SEC intervened then saying, “it’s a security issue.”

The developers retorted, “Nope, we are just selling tokens.”

The SEC hits back saying, “that is a security is because it qualifies as one according to the Howey Test.” The test was done and it make your token an investment of money. It also involves expectation of profits and a plenty of efforts from others.

The question is, why do we even have such regulation and investigation taking place?

And that leads us to another reason that states why this domain involves so many regulations. Dao was supposedly the biggest ICO but a trivial in the code made its cut its journey short and became a precedent for many.

This instance has already been mentioned but let’s look at its highlights again:

Dao’s smart contract was flawed.

The flaw was used by the hackers to procure another entry into the system.

It resulted into a fraud worth $150 million.

It soon turned out as one of the biggest scams in the history. Lots of people invested but noone got anything in return. That’s when, SEC comes into the picture and recognizes tokens as security.

As mentioned by the SEC CEO Jay Clayton, “ the repercussions of such projects on the markets are being studied, we value the innovation of technology and encourage people to actively participate in it. We look forward to distributed ledger and its benefits to markets, while also ensure that the interest of investors is protected.”

The decision was welcomed by the major of people in Crypto Community:

The Ripple CEO, Brad Garlinghouse said,

Regulators should remain in the picture. They exist for a good reason and that is the protection of customers from fraud.

However, the Bitcoin.com founder, Roger Ver disagreed with the decision saying, “this is the most regressive approach of our regulatory bodies which we have been saying for centuries.”

The Most Prominent Initial Coin Offering So Far

Let’s take a look at some of the most successful ICOs so far, the success of whose are marked as watershed.

Ripple

Ripple created its own anti-spam mechanism and introduced in its payment network. It launched 100 billion XRP tokens which were sold by Ripple Labs. Though they were met with a downward trend, their value steeped at many fronts. It started with the release of 5,000 Satoshi coins and went through bouts of fluctuations. It went down to 600 from 7000 and again rose to 3000.

Mastercoin

It was launched in 2013 with a plan to create a layer on top of Bitcoin. The Mastercoin-token was sold to investors and developers received approximately 10,000 Bitcoins which have been valued worth $1 million today. Few months after its launch, Mastercoin token acquired some value and some investors even gained huge profits. A little later, Mastercoin merged with Omni and Counterparty.

Ethereum

The largest ICO so far with presale of 60 million ETH tokens. The event became a massive success and raised 31,500 Bitcoin globally. It became the biggest crowdfunding event ever and marked the existence of cryptocurrency in the mainstream markets. Needless to say, investors were showered with huge profits.

EOS

In terms of its duration and magnitude of funds collected, it is the biggest ICO so far. Block.one launched EOS platform back in 2017 and it continued till 2018. That is also a reason which makes it the biggest success because it was run for longest period. After running for 1 whole year, the project managed to collect a staggering $4.1 billion.

The success of this ICO could be attributed to Dan Larimer’s other projects such as Steemit and BitShares. EOS aims to become a mainstream channel for facilitating industrial Dapps. Recently, the platform has faced some issues and reported technical snags. Still, EOS is believed to have the potential to fight them.

Augur

If you remember the once very popular TV show “Who Wants To Be A Millionaire?”, every partipant in the game used to have 3 lifelines. One of them was audience poll, which was basically, asking the answer from the audience. On being asked, the audience used to vote the option they believed was right. For the most part, audience got the answer right. It is often referred as “Wisdom Of The Crowd”, which suggests that most of the times, people are collectively right.

Augur is loosely based on this phenomenon and to build a prediction market, it managed to raise $5.2 million through the ICO.

Telegram

This is the platform which made end-to-end encryption possible. When the project was launched, it managed to raise $1.7 billion including SAFT agreements within the private sale. As a result, the public sale was called off. The CEO of Telegram, Pavel Valerievich Durov is also known as the Zuckerberg of Russia.

Two different sales were conducted which resulted in the collection of $850 million for each one of them. The funds were utilized for development of Telegram Open Network (TON) and it will be supported by GRAM token.

The motto of this project is to build a blockchain network which is scalabe enough to execute millions of transactions per second using “hypercube routing” and “infinite sharding”.

Dragon

Dragon drew worldwide attention not only for the merits of project, but also for its rumored association with Cambridge Analytica and a Macau-based gangster. It has become one of the most successful ICOs in history with a collection of whopping $320 million. It was introduced with the purpose of starting a casino in Macau, which is considered Asia’s gambling haven. The value of Dragon Coin, DRG, is driven by success of big gambling ventures and it targets the entire community of VIP gamblers in Macau.

Using its coin, gamblers can save money by converting their currency in money, which can used by used for gambling without the involvement of any middlemen.

Upshot

It has become extremely easy now to get ICO development services and kickstart your project. However, you must be careful before choosing any company as you project will give shape to your business. If you have reached this far on the article, we hope that you have a clear idea of how ICOs work. With the help of Coin Developer India, you can make your startup dream true and launch your own company. Our services will ensure that you get the best resources, strategy and resources.